Biosimilars savings vs Big Pharma cravings! $$$

- By

- Jonathan Jacobs

I’ve been intrigued with the why and how of biosimilars for some time and why there is very little public knowledge of there availability and possible cost savings to us all. The recent phase of skyrocketing inflation has us all looking for pathways to save money and prescription drug costs are front and center for examination. The following is an overhead view of this most intriguing market!

The cost of prescription medications in the US has gone up exponentially in recent years. I have a family of just three and our prescription medication costs with Insurance have continued to increase every year for the last decade. Every class of meds have increased, and Biologics are just one of many classes of drugs with skyrocketing prices however this is the largest class of drugs representing 40% of the market. Decades ago, the generic market developed as a cost saving option for many medications. An additional option has of course become Biosimilars. Generic drugs and biosimilars serve similar purposes: They are both unbranded versions of existing medications typically provided at a lower cost. By contrast, biosimilars are developed to be similar-to biological medicines that have already been approved and whose patent has expired. The active ingredient of the biosimilar and the originator are functionally the same, but there could be minor differences because of production methods and the complexity of the molecules involved.

Anyone who has paid for a medication in recent years can appreciate the cost savings from a brand to a generic medication.

Can Biologics save us money?

Quick overview:

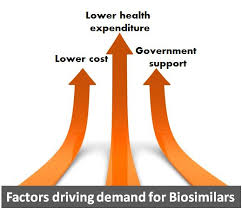

The FDA approved our first biosimilar, Sandoz’s Zarxio, five years ago, on March 6, 2015. The biosimilars industry is proving that market competition works to drive down drug costs and increase patient access to medicines. According to recent data from IQVIA, savings from biosimilars increased over 800% from 2018 to 2020, from under $900M in 2018 to $7.9B in 2020. These savings are projected to reach over $30B annually by 2022, and collectively will save the U.S. health care system $133B from 2021 to 2025.

Slow approval of many Biosimilars has a drag effect on the economy

As biologics represent 40% of total spending on prescription drugs, preventing the market entry of cheaper alternatives results in a massive strain on the healthcare industry. According to an FDA analysis, the US could have saved over $4.5 billion in medical spending, in 2017, if all of the approved biosimilar drugs had been made commercially available to patients in a timely fashion. Hard to believe that the drug companies would want to keep you from saving money? Really?

But it’s been a long journey and biosimilars have faced hurdles at every progression point. Every innovator company has filed legal action in some form against a biosimilar manufacturer to protect its patents and brand position, so before biosimilars even have a chance to compete, they are generally saddled with legal fees or settlement expenses, which have become another cost of entry.

Facts & The PBM Factor

It’s been a long journey and biosimilars have faced hurdles at every progression point. Every innovator company (Big Pharma usually) has filed legal action in some form against a biosimilar manufacturer to protect its patents and brand position, so before biosimilars even have a chance to compete, they are generally saddled with legal fees or settlement expenses, which have become another cost of entry. Just in the past six months, the FDA has approved the first interchangeable biosimilar products, including Semglee, the first interchangeable biologic insulin, and Cyltezo, an interchangeable biologic for Humira, the top-selling drug in the United States.

The PBM’s

Of course another stumbling block to market utilization are the PBM’s. The formularies for many of the largest plans are all controlled by the PBM’s who manage the pharmacy benefit, the payors in essense. Under the pharmacy benefit, payers have more authority to determine which drugs stay on the formulary and which ones are removed. Due to market consolidation, three large organizations—CVS Caremark, OptumRx and Express Scripts—now control 75% of the pharmacy benefit managers (PBMs) business in the U.S. As a result, companies often face a win-big-or-lose-big situation during contracting agreements. The resulting go-around is site of administration….because usually most biosimilars are dispensed through physician directions and authority this fell under the medical benefit. We have now moved to a system of self administration which allows the emphis to be on the pharmacy benefit. Additionally Physicians have become more comfortable prescribing biosimilars in general. Patients as well are open to a system with cost saving options.

The Coalition Against Patent Abuse (CAPA), a diverse coalition of healthcare providers, consumer groups, patient advocacy organizations, free-market advocates and others, issued a statement today supporting a new study entitled, “The Growing Power of Biotech Monopolies Threatens Affordable Care” by Avik Roy and Gregg Girvan of the Foundation for Research on Equal Opportunity (FREOPP) which reaffirms that American patients pay more for prescription drugs in the United States compared to any other country and a main factor driving these high drug prices is the lack of biosimilar competition for larger biologic drugs.

The Tide is Turning!

Competition is finally underway, and more market entrants are scheduled to arrive. More importantly, the second wave of biosimilar investment has begun. Five years ago, there were only a handful of manufacturers willing to take the risk and get in the game. Look at biosimilars now in the pipeline and studies in progress and you can see legacy brand manufacturers like Pfizer and Amgen, as well as generic manufacturers like Sandoz and Amneal, building biosimilar programs. Hopefully the last critical piece of the puzzle will fall allowing real savings to generate the marketplace. Public awareness! The FDA has also published guidance on biosimilars interchangeability that provides biosimilars companies with more clarity in product development. More favorable financing has also played a part. For instance, Medicare Advantage plans have been updated to allow step therapy to be used to identify the most cost-effective drug for outpatients, and to include biosimilars alongside brand-name drugs in the coverage-gap discount program for prescription drugs. The more competition and entrents into this sector of the marketplace means the more savings you and I can expect on some of the most important medications!

Click on the below links for more important Biosimilar information:

The most updated list of approved Biosimilars

Biosimilars and Interchangeable products

FDA Biosimilar Approval Recap 2021

Point of Care systems continues to urge everyone to stay up to date on the latest CDC Guidelines for Covid-19 prevention and protection and to maintain social distancing whenever possible. Over the past two years we have provided many pandemic related articles. Please take a look: